Triple-A vs. NOWPayments vs. Larecoin: Which Crypto POS System Actually Cuts Your Fees by 50%? (2026 Comparison)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant fees are killing your margins.

Traditional payment processors take 2-3% per transaction. Credit cards eat another chunk. Banks add their own fees on top.

You're looking at crypto payment solutions to escape this fee trap.

But here's the truth: most crypto POS systems just replicate the old model with new branding.

They still charge percentage-based fees. They still custody your funds. They still act like middlemen.

Three platforms dominate the conversation in 2026: Triple-A, NOWPayments, and Larecoin.

Only one actually delivers on that 50% fee reduction promise.

Let's break down the numbers.

The Real Cost Breakdown

Here's what you're actually paying with each platform:

NOWPayments: 0.5-1% per transaction Triple-A: 0.7-1.5% per transaction Larecoin: Gas fees only (no percentage markup)

Sounds similar on paper. The difference shows up at scale.

Fee Comparison at Real Transaction Volumes

Annual Volume | NOWPayments | Triple-A | Larecoin | Your Savings |

$500K | $2,500-$5,000 | $3,500-$7,500 | $250-$750 | $2,250-$6,750 |

$2M | $10,000-$20,000 | $14,000-$30,000 | $1,000-$3,000 | $11,000-$27,000 |

$5M | $25,000-$50,000 | $35,000-$75,000 | $2,500-$7,500 | $27,500-$67,500 |

Process $5 million annually?

Triple-A costs you up to $75,000. NOWPayments takes $50,000.

Larecoin? $2,500-$7,500 total.

That's $67,500 back in your pocket instead of processor fees.

Why Traditional Crypto Processors Charge Like Banks

NOWPayments and Triple-A built custodial platforms.

They hold your crypto. They manage your settlements. They control your funds.

That infrastructure costs money. They pass those costs to you as percentage fees.

You're paying them to act as the middleman you wanted to eliminate.

It's the banking model with a crypto wrapper.

How Larecoin Eliminates the Middleman

Larecoin runs on a fundamentally different architecture.

Self-custody from day one. You control your wallet. No platform holds your funds.

Gas-fee-only pricing. You pay blockchain network fees. Nothing else.

Direct settlement. Payments go straight to your wallet. No intermediary processing time.

This isn't incrementally better. It's structurally different.

Settlement Speed Matters More Than You Think

Larecoin: Sub-second finality on Solana NOWPayments: ~5 minutes average Triple-A: Varies by blockchain, often 10+ minutes

Faster settlement means faster access to working capital.

You're not waiting for "processing windows" or "settlement periods."

The transaction confirms. The funds are yours. Move on to the next customer.

The Master/Sub-Wallet Advantage

Running multiple locations? E-commerce plus retail?

NOWPayments gives you one merchant account. Want separate tracking? You're setting up multiple accounts.

Triple-A requires separate integrations per location. More complexity. More management overhead.

Larecoin uses a master/sub-wallet system.

Unlimited payment endpoints. One dashboard. Individual tracking for each location or department.

You get granular control without management chaos.

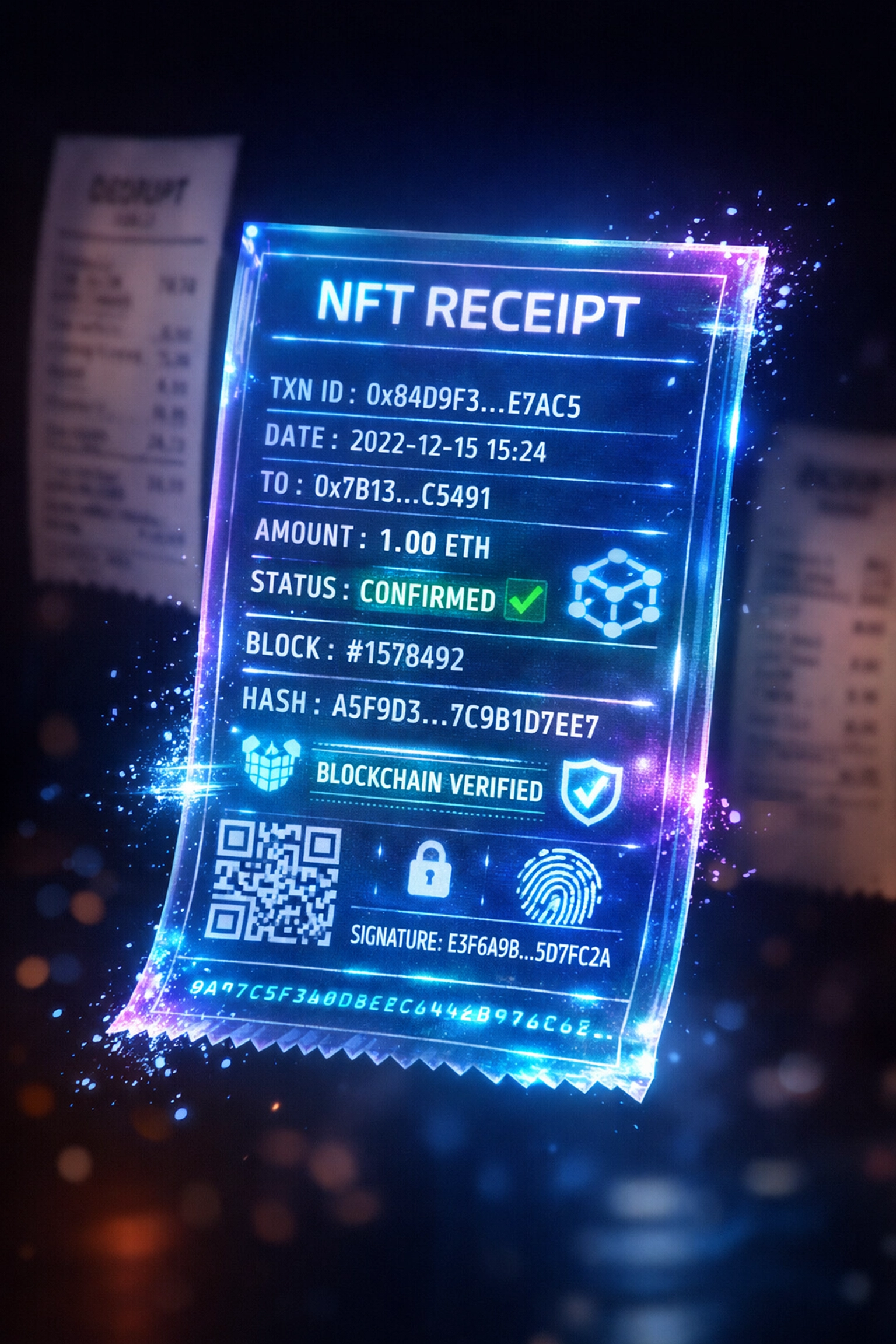

NFT Receipts: Your Accounting Department Will Thank You

Every Larecoin transaction generates an NFT receipt.

Immutable. Can't be altered or faked. Blockchain-verified. Independent audit trail. Permanently accessible. No "lost receipt" excuses.

Tax season becomes straightforward. Audits become simple. Accounting reconciliation takes minutes instead of days.

Traditional processors give you CSV exports and email confirmations.

Larecoin gives you cryptographic proof of every transaction.

LUSD vs. USDC: The Stablecoin Nobody's Talking About

Triple-A and NOWPayments default to USDC or USDT.

Centralized stablecoins. Subject to freeze functions. Controlled by corporate entities.

Larecoin integrates LUSD: a decentralized, over-collateralized stablecoin.

No freeze risk. Nobody can lock your funds. No centralized control. No single entity can devalue the peg. Proven stability. Battle-tested through multiple market cycles.

You want sovereignty over your business finances? The stablecoin choice matters.

Setup Complexity: The Hidden Cost

Triple-A: Compliance documentation required before activation. KYB process. Waiting period for approval.

NOWPayments: API integration needed. Developer involvement. Technical setup time.

Larecoin: QR-code-generated POS. No API required. No developer needed. Operational in minutes.

You're not building software. You're running a business.

Setup should take minutes, not weeks.

Cryptocurrency Coverage: More Isn't Always Better

CoinPayments: 2,000+ cryptocurrencies supported NOWPayments: 200-300+ coins Larecoin: Focused Solana ecosystem with cross-chain bridges

Supporting thousands of obscure coins adds complexity without value.

How many customers actually want to pay with DogeCoin variant #847?

Larecoin focuses on high-liquidity assets. Solana ecosystem coins. Cross-chain bridges for major networks.

You get practical coverage without management overhead.

The Bank-Free Business Model

Traditional processors still require bank connections.

You're "accepting crypto" but settling to fiat through banking rails.

That defeats the purpose.

Larecoin operates entirely on-chain. No banking integration required.

True financial sovereignty. Global reach by default. No geographic restrictions based on banking relationships.

This is what Web3 global payments actually means.

Who Each Platform Serves Best

Triple-A: Large enterprises with compliance teams and multi-month implementation timelines.

NOWPayments: Mid-size businesses with technical staff and traditional payment processor mindsets.

Larecoin: Any business wanting maximum fee reduction, self-custody, and instant deployment.

You can scale from single-location retail to global e-commerce without changing platforms.

The Real Question: What's Your Annual Transaction Volume?

Under $100K annually? The fee differences are modest across platforms.

Between $500K-$2M? Larecoin saves you five figures yearly.

Above $2M? The savings become transformational. We're talking $30K-$60K+ annually.

That's not a cost center optimization. That's found revenue.

Making the Switch

Migration isn't complex.

Larecoin's QR-based system works alongside existing infrastructure. You're not replacing everything overnight.

Test with low-volume locations first. See the fee difference yourself. Scale from there.

Most merchants run parallel systems for 30-60 days before full transition.

Zero risk. Complete control.

The 2026 Reality Check

Crypto payments aren't experimental anymore.

They're mainstream merchant infrastructure.

The question isn't whether to accept crypto. It's which platform gives you maximum advantage.

Percentage-based fees made sense in 1995. They don't in 2026.

Custodial solutions made sense when self-custody was complex. It isn't anymore.

You have options. Choose the one that actually reduces your costs instead of replicating old problems.

Ready to cut your payment processing fees by 50%+?

Visit Larecoin and deploy your first POS terminal today.

No developers needed. No lengthy onboarding. No percentage-based fees eating your margins.

Just gas-fee-only payments settled directly to your self-custody wallet.

The merchants saving $30K-$60K annually aren't smarter than you.

They just stopped overpaying for payment processing.

Comments