Why the CLARITY Act Will Change the Way You Accept Crypto Payments (And What It Means for Larecoin in 2026)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

The Regulatory Game Just Changed

February 2026. The CLARITY Act (H.R. 3633) is reshaping crypto payments.

Businesses accepting digital assets no longer operate in regulatory fog. The act splits jurisdiction cleanly: SEC handles securities, CFTC oversees commodities.

Larecoin falls squarely into commodity territory. That matters more than you think.

What CLARITY Actually Does for Payment Processors

Clear compliance pathways. No more guessing which regulator shows up at your door.

Protected infrastructure. Developers building wallets and validators running nodes aren't classified as financial intermediaries. They can operate without registration burdens.

Predictable enforcement. The surprise crackdowns that plagued crypto businesses from 2022-2025 are over. You know the rules. Follow them. Done.

For Larecoin merchants, this translates to reduced legal risk when accepting LARE tokens. Your business isn't gambling on regulatory interpretation anymore.

Why Commodity Classification Wins for Larecoin

The CFTC route gives Larecoin distinct advantages over security-classified tokens.

Liquidity access. Commodities can trade on futures markets and derivatives platforms. Larecoin can integrate with mainstream financial products.

Institutional adoption. Banks and payment processors are more comfortable handling commodity-based digital assets. Lower compliance overhead. Faster partnerships.

Stablecoin integration. LUSD, Larecoin's native stablecoin, benefits from explicit CFTC frameworks. The GENIUS Act complements CLARITY by establishing clear stablecoin rules: no interest for issuers, but reward structures for platforms remain viable.

Compare this to NOWPayments or CoinPayments. They process multiple tokens, many caught in SEC gray zones. Merchants using those platforms carry regulatory uncertainty for every transaction.

Larecoin offers clean commodity status. One regulatory framework. Zero ambiguity.

The 50% Fee Savings Nobody's Talking About

Legacy payment processors extract 2.5-3.5% per transaction. Credit cards add another layer of fees.

Larecoin's LareBlocks Layer 1 operates on gas-only transfers. Merchants pay blockchain fees. Nothing else.

Typical breakdown:

Traditional processor: 2.9% + $0.30 per transaction

Larecoin: Gas fees averaging $0.02-0.05 per transaction

For a $100 transaction, you're saving $2.85. Scale that across 10,000 monthly transactions. That's $28,500 back in your business annually.

NOWPayments charges 0.5-1% per crypto transaction. Better than cards. Still bleeding margin.

CoinPayments takes 0.5% plus network fees. Again, an improvement. But not revolutionary.

Larecoin cuts the middleman completely. Self-custody. Your keys. Your coins. Zero platform fees.

LUSD Stablecoin: The Compliance-Ready Payment Rail

LUSD operates under the new stablecoin framework established by CLARITY's companion legislation.

Key features:

1:1 USD backing with transparent reserves

Instant settlement on LareBlocks Layer 1

No interest paid to holders (compliant with GENIUS Act restrictions)

Compatible with push-to-card services for immediate fiat conversion

Merchants accepting LUSD eliminate volatility risk. Customers pay with stable value. You receive stable value. The blockchain handles settlement in seconds.

Platforms like NOWPayments offer stablecoin processing. But they rely on third-party stablecoins: USDT, USDC, others. Each carries separate regulatory profiles. Multiple compliance frameworks.

Larecoin's LUSD is purpose-built for the post-CLARITY environment. One coin. One framework. Native integration.

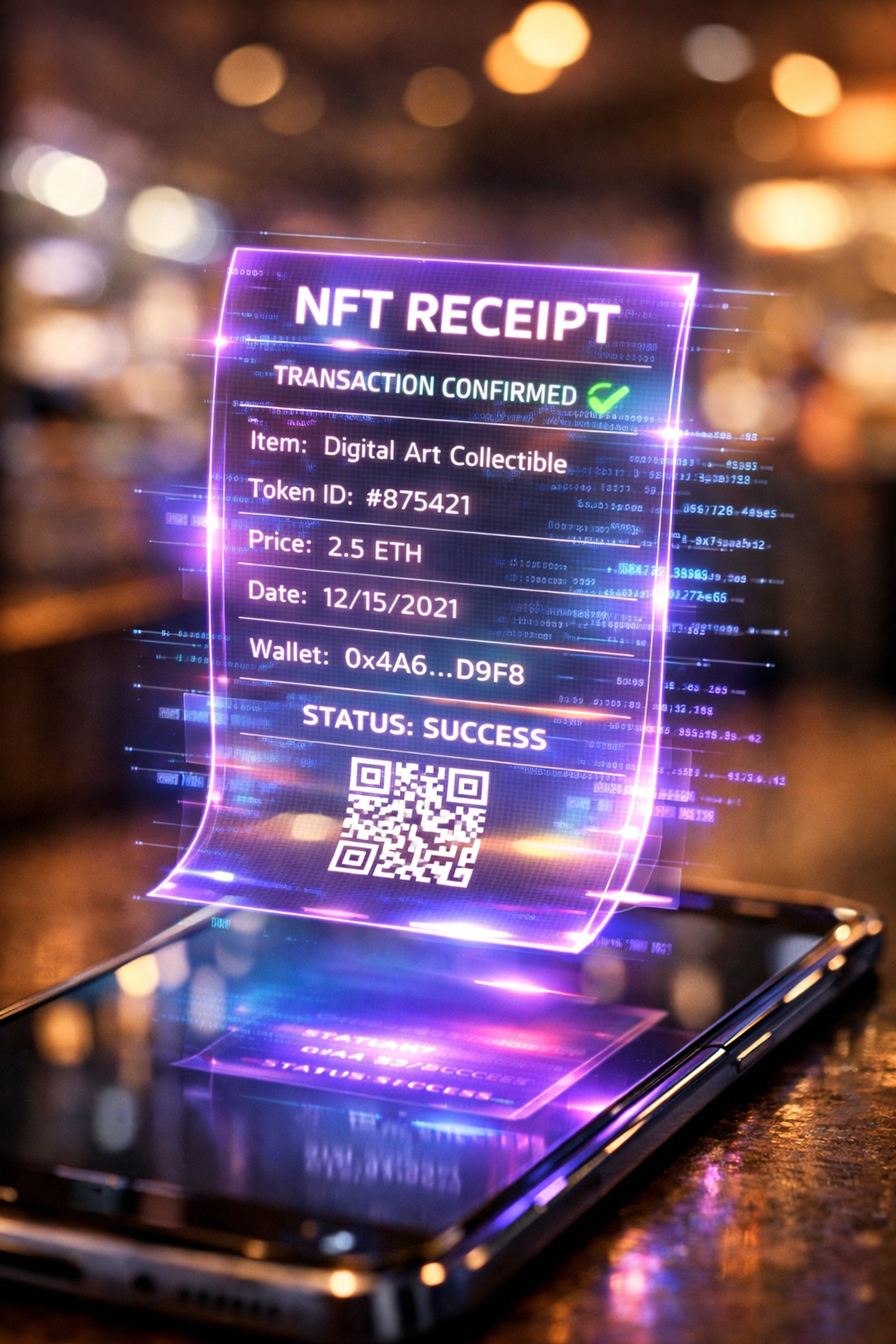

NFT Receipts: Web3-Native Transaction Records

Every Larecoin payment generates an optional NFT receipt minted on LareBlocks.

Why this matters:

Permanent, immutable transaction records

Customer loyalty integration via NFT collections

Proof of purchase for warranty claims or returns

Secondary market potential for limited-edition receipts

Traditional payment processors store transaction data on centralized servers. Vulnerable to breaches. Subject to data retention policies.

NFT receipts live on-chain. You control access. Customers control their records. Nobody can alter history.

LareBlocks Layer 1: Security Without Compromise

Self-custody isn't just a philosophy. It's a regulatory shield.

Under CLARITY, businesses maintaining custody of customer assets face heightened reporting requirements. Custodial exchanges must register. Compliance costs spike.

LareBlocks enables non-custodial payment flows. Merchants receive funds directly to their wallets. No intermediary holds assets. No custodial liability.

Security advantages:

Multi-signature wallet support

Hardware wallet compatibility

Smart contract audit trails

Real-time blockchain validation

CoinPayments operates as a custodial service. They hold funds during processing. That's convenient. It's also a regulatory burden post-CLARITY.

NOWPayments offers both custodial and non-custodial options. Better. But their non-custodial flows require API integration complexity.

Larecoin defaults to self-custody. Simple setup. Maximum security. Minimum compliance friction.

AI-Powered Metaverse Shopping: The 2026 Differentiator

CLARITY doesn't just affect traditional e-commerce. It establishes frameworks for virtual world transactions.

Larecoin's AI shopping assistant operates inside metaverse environments. Customers browse virtual stores. The AI handles payment routing, currency conversion, and NFT minting automatically.

Real-world application:

Virtual storefront accepts LARE or LUSD

Customer selects products via avatar

AI assistant processes payment through LareBlocks

NFT receipt mints automatically

Physical product ships to customer's address

No other payment processor offers native metaverse integration. NOWPayments requires custom SDK development. CoinPayments lacks virtual world APIs entirely.

Larecoin built for Web3 from day one. Metaverse commerce isn't a future feature. It's live infrastructure.

The Developer Protection Nobody Saw Coming

CLARITY's Digital Commodity Intermediaries Act (DCIA) component protects software builders.

Publishing wallet code isn't regulated activity. Running a validator node doesn't trigger registration requirements. Contributing to blockchain core development is explicitly protected speech.

For Larecoin's open-source ecosystem, this is massive.

What it enables:

Third-party wallet developers can build on LareBlocks freely

Payment plugin developers aren't liable for merchant compliance

Community validators operate without licensing burdens

API integrations don't classify as money transmission

This protection accelerates ecosystem growth. More developers building. More tools launching. More merchant integrations going live.

Competing platforms operating under older regulatory interpretations can't match this velocity.

Setting Up Larecoin Payments in 2026

Step 1: Generate LareBlocks wallet address at larecoin.com

Step 2: Install payment gateway plugin (WooCommerce, Shopify, custom API)

Step 3: Configure LARE or LUSD acceptance

Step 4: Enable optional NFT receipt minting

Step 5: Connect push-to-card service for instant fiat conversion

Total setup time: Under 30 minutes.

Compare to NOWPayments: Account verification, KYC documentation, API key management, webhook configuration. Timeline: 3-5 business days.

CoinPayments: Similar process. Additional merchant verification for higher limits.

Larecoin's non-custodial approach eliminates verification bottlenecks. You control the wallet. You're immediately operational.

The Competitive Edge for Merchants

Cost structure:

Larecoin: Gas fees only (avg $0.02-0.05 per transaction)

NOWPayments: 0.5-1% per transaction

CoinPayments: 0.5% plus network fees

Settlement speed:

Larecoin: Instant (LareBlocks confirmation in 2-3 seconds)

NOWPayments: Varies by blockchain (2-60 minutes)

CoinPayments: Blockchain dependent (5-120 minutes)

Regulatory clarity:

Larecoin: CFTC commodity classification under CLARITY Act

NOWPayments: Multi-token compliance complexity

CoinPayments: Mixed regulatory profiles across supported assets

Innovation features:

Larecoin: NFT receipts, AI shopping, metaverse native

NOWPayments: Standard crypto processing

CoinPayments: Standard crypto processing with custodial wallets

The math is straightforward. Lower fees. Faster settlement. Clearer compliance. Native Web3 features.

What Happens Next

The CLARITY Act passed. Regulatory fog lifted.

Larecoin positioned perfectly as commodity-classified payment infrastructure. Merchants save 50% on fees. Customers transact with confidence. Developers build without regulatory fear.

LUSD provides stablecoin rails. NFT receipts create permanent records. LareBlocks ensures self-custody security. AI shopping powers metaverse commerce.

Legacy processors are scrambling to adapt. Larecoin already compliant. Already operational. Already scaling.

Ready to accept crypto payments the right way? Start at larecoin.com.

The regulatory framework finally matches the technology. Time to capitalize.

Comments