Bank-Free Business Operations: The Ultimate Guide to Self-Custody Merchant Accounts That Cut Fees and Give You Full Control

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Banks are scared.

And they should be.

Self-custody merchant accounts are eliminating their stranglehold on business payments. No more 3% interchange fees. No more 5-day settlement holds. No more frozen accounts.

Just direct payments from customer to merchant. On the blockchain. Instantly.

What Self-Custody Merchant Accounts Actually Are

Simple concept: You hold the keys. You control the funds.

Traditional merchant accounts? Payment processors control everything. Your revenue sits in their bank. They decide when you get paid. They set the fees unilaterally. They freeze accounts whenever they feel like it.

Self-custody flips the script.

Customers pay directly into your wallet. Not Stripe's. Not PayPal's. Yours.

The transaction broadcasts to the blockchain. Cryptocurrency transfers from their wallet to yours. No intermediary approval needed. No holding periods. No third-party access to your private keys.

You own the infrastructure of your payment system.

How Self-Custody Payments Work (3-Step Process)

Step 1: Customer initiates payment at checkout or POS

Step 2: Transaction broadcasts directly to blockchain

Step 3: Funds arrive in your wallet. Seconds, not days.

That's it.

No bank review. No compliance delay. No "suspicious activity" flags that lock up your working capital for weeks.

Larecoin builds on this foundation with advanced features competitors like NOWPayments and CoinPayments can't match. NFT receipts for automatic accounting integration. LUSD stablecoin options to eliminate volatility. Master/sub-wallet management for multi-location operations.

All while maintaining complete self-custody.

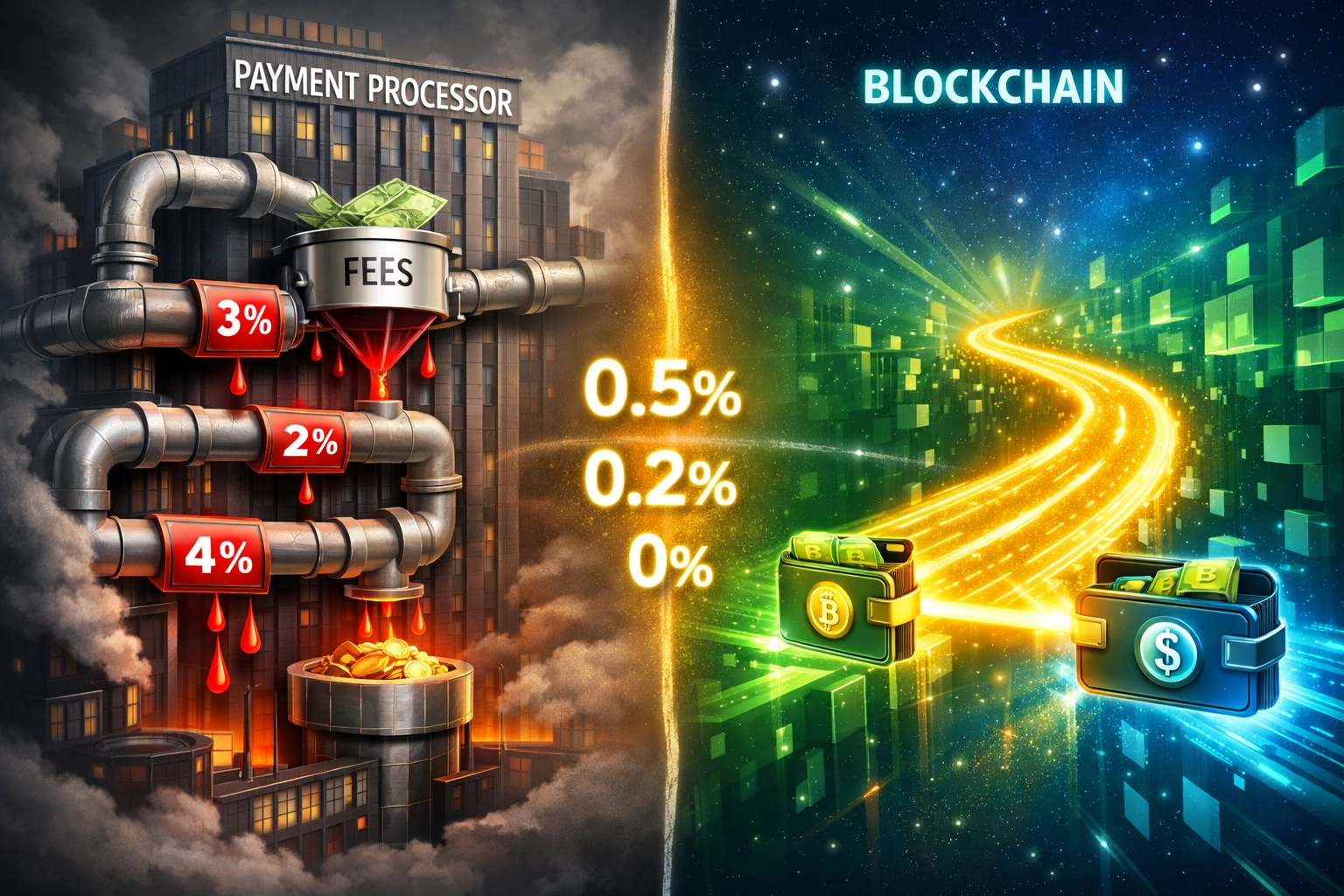

The Fee Massacre: Traditional vs. Self-Custody

Traditional merchant processing bleeds businesses dry:

2.9% + $0.30 per transaction (standard rates)

Cross-border fees: additional 1-2%

Currency conversion: another 2-3%

Chargeback fees: $15-$100 each

Monthly gateway fees: $25-$50

PCI compliance costs: $100-$500/year

Total cost for high-volume merchants: 4-7% of revenue vanishes.

Self-custody with Larecoin:

Blockchain gas fees: under $1 per transaction

No intermediary percentage cuts

No monthly gateway fees

No compliance overhead

No chargeback vulnerability (crypto transactions are final)

Savings: 50-80% reduction in payment processing costs.

A business processing $100,000 monthly saves $3,000-$7,000 every single month. That's $36,000-$84,000 annually returning to your bottom line instead of enriching payment processors.

Instant Settlement Changes Everything

Traditional processing: Wait 3-5 business days for deposits.

Self-custody: Funds available in 10 seconds to 3 minutes.

This cash flow difference transforms business operations. No more:

Bridging loans to cover payroll

Maxed credit lines waiting for settlement

Lost early payment discounts from suppliers

Stress about timing invoices around deposit schedules

Money hits your wallet when the customer pays. Not when a processor decides to release it.

Larecoin extends this with receivables token functionality: convert incoming payments into tradeable assets before they even settle. Access working capital instantly without factoring companies taking their 3-5% cut.

Full Control Means No More Account Freezes

Payment processors freeze merchant accounts constantly:

"Unusual activity" (translation: you're succeeding)

"High-risk industry" (translation: we don't like your niche)

"Policy violation" (translation: vague excuse to hold your money)

With self-custody, your private keys = your control. No compliance department can cut off access. No arbitrary policy changes. No "under review" status locking up $50,000 in revenue.

Your wallet. Your keys. Your funds. Always.

Competitors like CoinPayments and Triple-A still maintain custodial control. They hold your crypto. They decide access rules. They can freeze withdrawals.

Larecoin's self-custody architecture ensures true financial sovereignty.

The Security Responsibility Trade

Full control = full responsibility.

You must secure private keys properly. Lost keys mean permanent loss of funds. No customer service line can reset your password.

Essential security practices:

Hardware wallet storage for significant balances

Multi-signature requirements for large transfers

Encrypted backups in multiple secure locations

Clear succession planning for key management

Regular security audits

The upside? Your security depends on your implementation, not someone else's database.

Traditional processors suffer data breaches constantly. Equifax. Capital One. Target. When Visa's network gets compromised, every merchant using it becomes vulnerable.

With self-custody, you're only as vulnerable as your own security setup. One customer breach doesn't expose thousands of merchants.

Larecoin provides enterprise-grade security tools while maintaining self-custody:

Hardware wallet integration

Multi-sig wallet options

Automated backup protocols

24/7 security monitoring (of the network, not your keys)

Who Benefits Most from Self-Custody Merchant Accounts

High-risk businesses: CBD, adult content, nutraceuticals, firearms: industries traditional processors reject or charge 5-10% rates.

International sellers: Cross-border fees disappear. Accept payments from 180+ countries with identical low gas fees.

High-volume merchants: The fee savings scale dramatically. Process $1M monthly? Save $40,000-$70,000 annually.

Privacy-focused operations: No intermediary surveillance. No data sharing with banks. No transaction monitoring beyond blockchain transparency.

Crypto-native customers: Web3 businesses serving customers who prefer crypto payments naturally.

Larecoin's merchant growth data shows businesses across all these categories slashing fees by 50%+ within their first month.

NOWPayments vs. CoinPayments vs. Larecoin: The Control Difference

NOWPayments:

0.5% processing fee

Custodial model (they hold your crypto)

Basic checkout integration

Limited accounting features

CoinPayments:

0.5% processing fee

Custodial model with withdrawal delays

Multi-coin support

Larecoin:

Gas-only fees (no percentage cut)

True self-custody (you hold keys)

NFT receipts for automatic accounting

LUSD stablecoin integration

Receivables token for instant liquidity

Master/sub-wallet enterprise management

The difference? Control and cost.

Competitors still charge percentage fees on your revenue. They still maintain custody. They still decide withdrawal timing.

Larecoin eliminates intermediary control entirely.

Getting Started: 5 Minutes to Bank-Free Operations

Setup process:

Create Larecoin Smart Wallet (2 minutes)

Generate merchant QR codes or checkout links (1 minute)

Start accepting payments (immediate)

No credit check. No application process. No waiting for approval.

Traditional merchant accounts take 5-10 business days for approval. Self-custody? Operational in minutes.

For enterprises requiring multiple locations or departments, Larecoin's B2B2C architecture provides master/sub-wallet functionality. Each location maintains independence. Corporate maintains unified reporting and self-custody oversight.

The Future Is Bank-Free

Traditional payment processors hate self-custody. It eliminates their profit extraction model entirely.

That's precisely why merchants love it.

Lower fees. Check. Faster settlement. Check. Complete control. Check. No permission needed. Check.

Banks fought the internet. They fought mobile payments. They're fighting crypto now.

They'll lose this battle too.

Self-custody merchant accounts aren't the future. They're the present for businesses prioritizing financial sovereignty over convenience.

Ready to cut fees by 50%+ and take complete control of your payment infrastructure?

Explore Larecoin's self-custody merchant solutions and join the bank-free revolution.

Your revenue. Your wallet. Your rules.

Comments